If you’ve been imagining about buying a house, mortgage costs are probably prime of thoughts for you. They may well even be why you have put your ideas on keep for now. When charges climbed in close proximity to 8% past calendar year, some consumers identified the figures just didn’t make feeling for their spending plan any longer. That may well be the scenario for you far too.

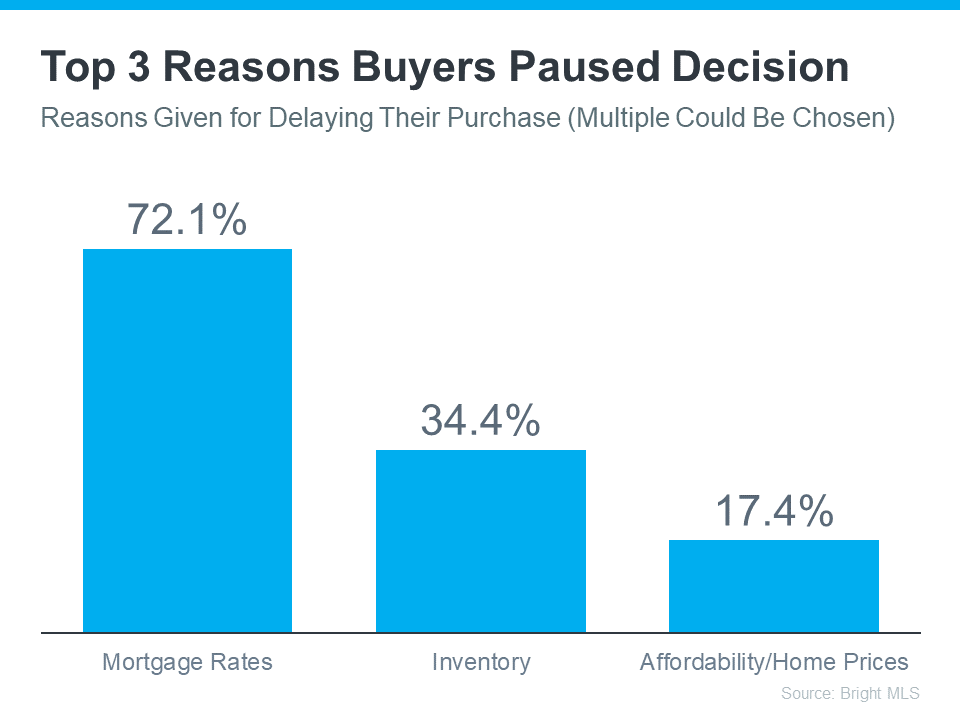

Data from Brilliant MLS shows the major cause buyers delayed their plans to move is owing to substantial home loan fees (see graph beneath):

David Childers, CEO at Preserving Recent Issues, speaks to this statistic in the latest How’s The Market podcast:

“Three quarters of potential buyers explained ‘we’re out’ thanks to mortgage costs. Here’s what I know going ahead. That will change in 2024.”

Which is mainly because mortgage loan fees have occur down off their peak very last October. And even though there’s nevertheless day-to-working day volatility in costs, the more time-expression projections clearly show fees ought to proceed to fall this yr, as prolonged as inflation receives beneath command. Industry experts even say we could see charges under 6% by the conclude of 2024. And that threshold would be a gamechanger for a good deal of prospective buyers. As a recent write-up from Realtor.com claims:

“Obtaining a dwelling is still sought after and sought following, but several individuals are on the lookout for home loan premiums to come down in buy to obtain it. 4 out of 10 Individuals wanting to buy a property in the upcoming 12 months would take into consideration it achievable if costs drop underneath 6%.”

Though home finance loan rates are almost extremely hard to forecast, the optimism from the authorities should really give you perception into what is forward. If your ideas had been delayed, there is mild at the end of the tunnel all over again. That implies it may possibly be time to commence considering about your transfer. The ideal problem you can request oneself right now, is this:

What range do I want to see costs strike prior to I’m completely ready to go?

The actual share where you experience relaxed kicking off your look for once again is personalized. It’s possible it is 6.5%. Maybe it’s 6.25%. Or probably it’s the moment they drop under 6%.

The moment you have that quantity in thoughts, here’s what you do. Connect with a neighborhood genuine estate specialist. They’ll assistance you continue to be informed on what is going on. And when premiums strike your focus on, they’ll be the to start with to let you know.

Base Line

If you’ve set your designs to shift on keep due to the fact of exactly where home finance loan fees are, consider about the range you want to see charges strike that would make you ready to re-enter the market place.

When you have that quantity in head, hook up with a actual estate expert so you have another person on your side to enable you know when we get there.

![The Latest Trends in Housing [INFOGRAPHIC] Simplifying The Market](https://youpay2.com/wp-content/uploads/2024/03/The-Latest-Trends-in-Housing-INFOGRAPHIC-150x150.png)